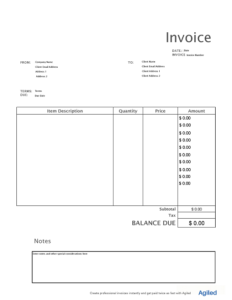

Get paid for your specialized services quickly and ideally with the free software development invoice template from Agiled. Download and make your billing process easy and fast.

Send Professional Invoices With Agiled.

As a professional software developer, you need the perfect invoicing software to bill your clients. With the help of our editable and professional invoice templates, you can easily create and send well-designed, detailed, and precise invoices to your clients with just a few clicks.

Our beautiful and customizable invoice templates are designed so that they meet all your business needs ideally.

You can create professional invoices with these free downloadable invoice templates in Google Sheets, Google Docs, PDF, Excel, Word.

Take advantage of this beautiful and editable invoice template and make your billing process easy and fast. Feel free to download it.

Download, customize and send this invoice template to your clients and let them know exactly when and how you expect to get paid for your services.

Download this ready-to-use invoice template and get the perfection billing solution for your business. It is a compact invoice template.

If you have professional and perfect invoicing software, you do not need to hire an accountant because you can easily manage all your financial issues with the invoice’s help.

Create professional and detailed software development invoices with Agiled and take your business’s standard to the next level effortlessly.

You can enjoy a lot of advantages with Agiled, some of them are as follows.

With a software development invoice, you can easily and quickly describe all the details of your services, prices, total cost, payment instructions, and more. Adding all of this information ensures that you are giving your clients precise information to quickly come to know what they need to pay you on time in the right way.

Regarding the timing of issuing invoices, invoices are documents that need to be issued in response to invoices that accompany the provision of services and goods. Therefore, it is not realistic to issue an invoice earlier than the delivery, such as when an order is placed.

The invoice will be issued at the same time as the delivery or after the delivery. In general, we often use a method called the “every time method” in which a transaction occurs, and a bill is charged each time the product is delivered. Adopting this method has the advantage of improving the cash flow of the company.

Besides, if billing is done many times a month or regular transactions every month, we may adopt a “payment method” in which billing is billed in a lump sum. Make sure to consider the relationship with your business partners and your company’s cash flow.

The role of the invoice is to collect the payment for the provision of services and services. In other words, an invoice is issued to receive money firmly. Therefore, the invoice has a fixed retention period to prove the transaction, and the invoice may be a piece of evidence if payment is not made.

If a sole proprietor or freelancer issues an invoice, should the withholding amount to be collected be written on the invoice anyway?

However, suppose the business partner is also a sole proprietor or a freelancer. In that case, the other party is not obliged to withhold tax unless it is subject to tax withholding, so of course, it is not necessary to enter the withholding amount on the invoice.

Other than that, if the corporation is a business partner, it is not subject to tax withholding and may or may not be filled out on the invoice. However, withholding fees, etc., are subject to withholding obligations to business partners. Therefore, considering our business partners’ convenience, it is better to include the withholding tax amount on the invoice.

Without a professional and detailed invoice, it could be challenging getting paid immediately and ideally. Here are some main invoicing tips that help you create a professional and effective invoice.

Numbered the invoice: With invoice numbers, you can easily keep track of all invoices effortlessly.

Include a ‘payment due date: Including the payment due date in the invoice helps your client know when you expect to get paid.

Include up-to-date contact information: After entering the invoice’s basic contact details, it is better to recheck it.

Accept a variety of payment methods: A variety of payment methods enable you to receive your payments as soon as possible.

You might get confused while developing the software, but with Agiled, you can easily create a well-organized and detailed invoice in a minute.

Follow the given steps and get your professional and crystal clear invoice before long.

Invoices play a very important role to get paid promptly and ideally, so you can not ignore the importance of invoices.

For your easement Agiled facilitates you with various types of invoices so that you could easily receive the reward of your all hard work in the right way immediately.

Here are some key invoice types for software developers:

Get started today with Agiled and bill your clients with the invoice that suits you the most.

Our stylish and customizable templates cover a wide range of services and business structures, such as IT support and consulting web development, photography, and more.

The endless opportunities are waiting for you to come forward and take the standard of your business and life to the next level effortlessly.